Investors Demonstrate Strong Demand To Acquire Multifamily Assets in Third Quarter

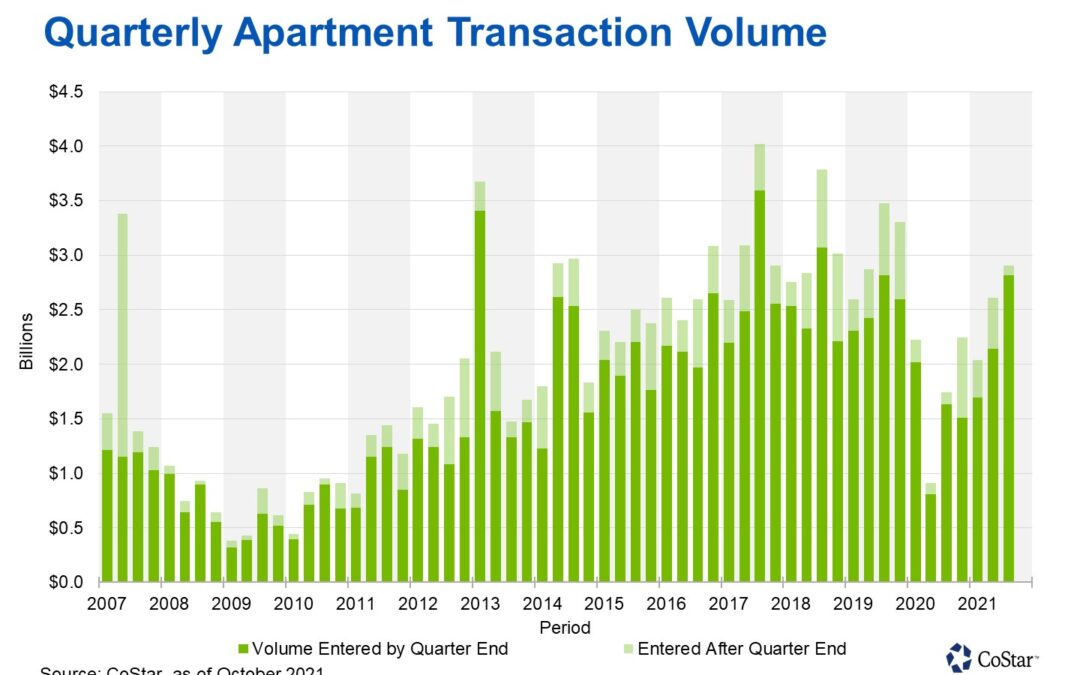

Sales volume in Los Angeles County during the third quarter was strong, totaling $2.9 billion, the highest level in a single quarter since late 2019. Average pricing per unit, which had flatlined during 2020, continues to rise in 2021.

Investors are intensely focused on obtaining multifamily properties in greater Los Angeles.

The largest apartment sale during the quarter closed in August, when Prime Group acquired two adjacent properties in Hermosa Beach from Equity Residential. The 285-unit Playa Pacifica and the 169-unit the Gallery traded for $275 million, or about $606,000 per unit, representing the largest apartment sale in Hermosa Beach’s history. The three-star communities were built in the 1970s just blocks from the Pacific Ocean, and after the sale were combined into a single property known as the Gallery at Playa Pacifica by Prime. The complex was 95% leased at the time of sale, with a low in-place capitalization rate of 3%.

The second largest sale in the quarter was in July, when Abacus Capital Group purchased the 298-unit Eton Warner apartments for $112 million, or roughly $376,000 per unit, from Crow Holdings. Crow had owned the property since 2014, when it acquired the newly built property for $95 million, or $319,000 per unit.

Author Credit: CoStar Analytics