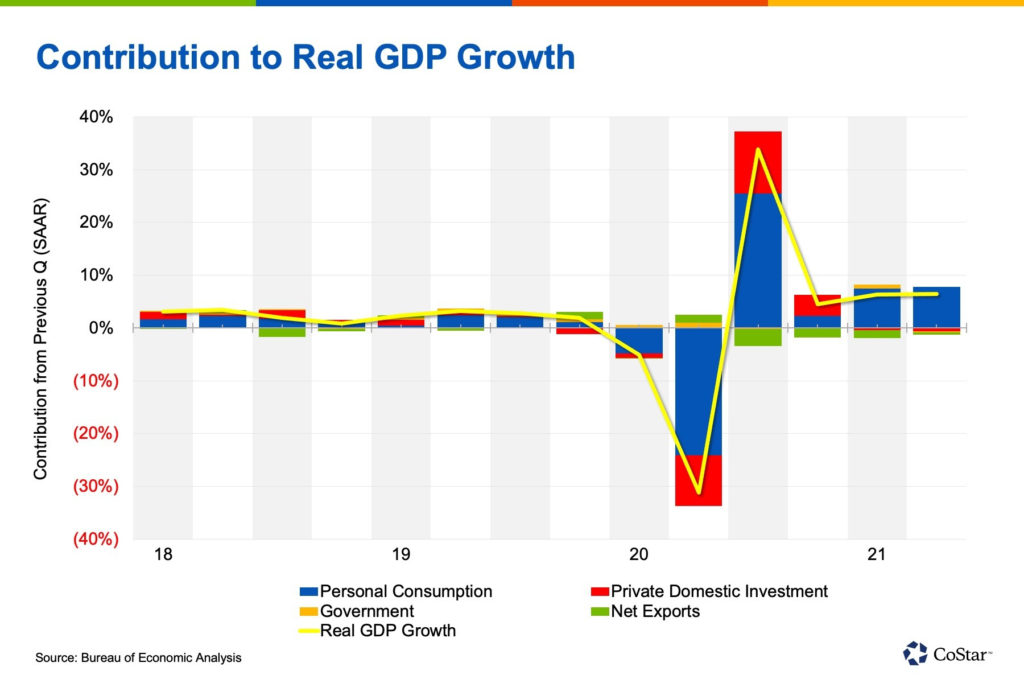

| In hindsight, hints that real gross domestic product would grow below projections were brewing based on recent inflation reports. After all, the “real” in real GDP implies that nominal output is deflated by the rate of inflation. Last week, the Bureau of Economic Analysis reported second-quarter growth of 6.5% on a seasonally adjusted annualized rate — roughly 200 basis points below the consensus estimate. Meanwhile, the GDP deflator measuring changes in prices for all goods and services came in at 6.1% in the quarter, indicating an acceleration of price increases over the quarter. |

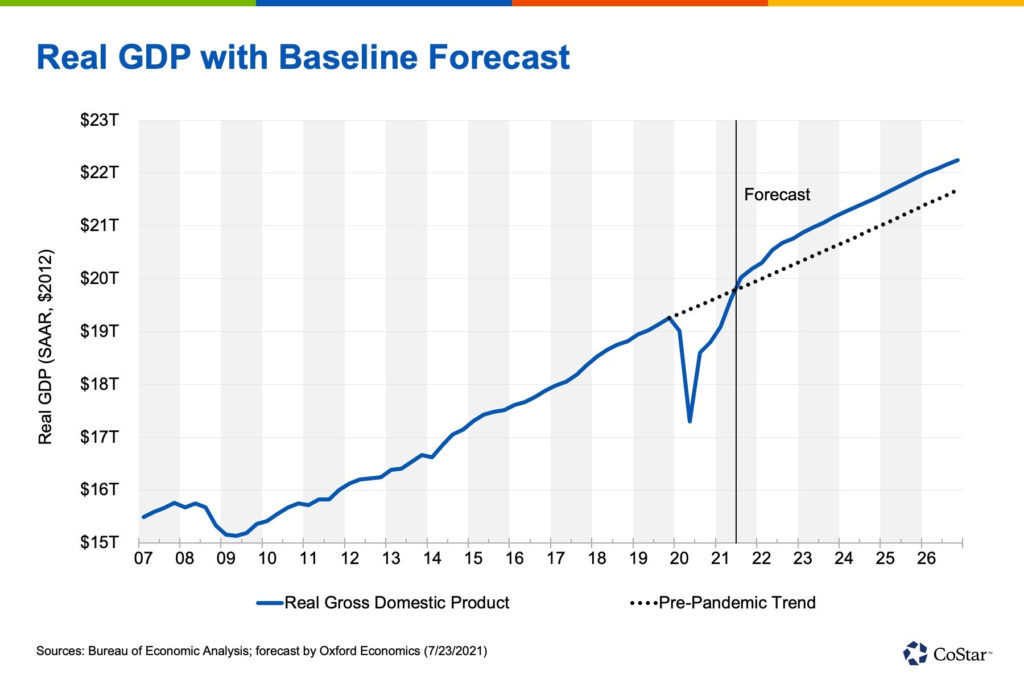

| With this latest report, the economy has recovered to its pre-pandemic level of economic output, and with robust growth projected through the end of the year, the U.S. is expected to surpass its pre-pandemic trend before 2022. Consumption, now accounting for more than 70% of GDP, was the sole contributor to growth among the four major categories, increasing by 11.8%, annualized, over the prior quarter. |

Net trade has also been a drag on growth. Economic activity in the U.S. is outpacing that of the nation’s global partners. While exports showed healthy growth in the quarter, at 6%, imports grew more quickly at 7.8%, causing a 1.6 percentage point draw from GDP growth.

Government spending, meanwhile, fell in the second quarter and reduced real GDP growth by 0.3 percentage points. Most of the decline came from non-defense spending and, more specifically, a reduction in the processing and administration of Paycheck Protection Program loan applications.

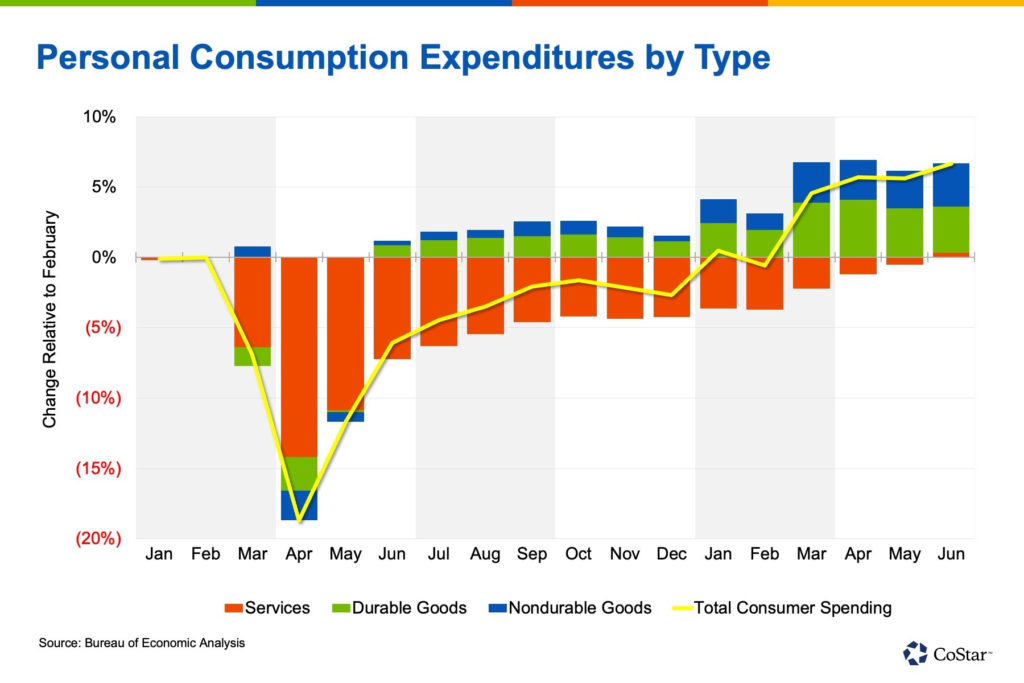

Consumers continued their strong spending in June, according to a related release from the Department of Commerce on Friday, but are now moving away from purchases of durable goods such as automobiles and sports equipment, which were down by 1.5% over May.

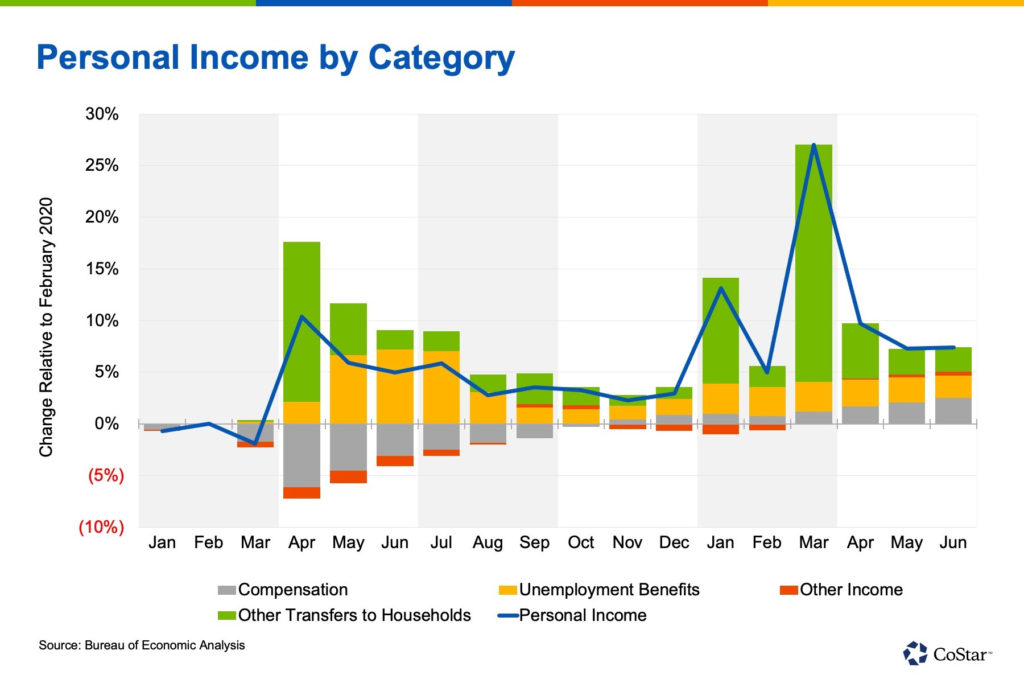

While reopening allows consumers to go out and about, their ability to spend has been largely enabled by healthy household balance sheets, substantial levels of excess savings and continued government support in the form of direct payments, enhanced unemployment benefits, mortgage and rent relief for families affected by COVID, as well as deferred student loan payments. Notably, such so-called transfer payments fell for the third month in a row, while employee compensation continues its upward climb.

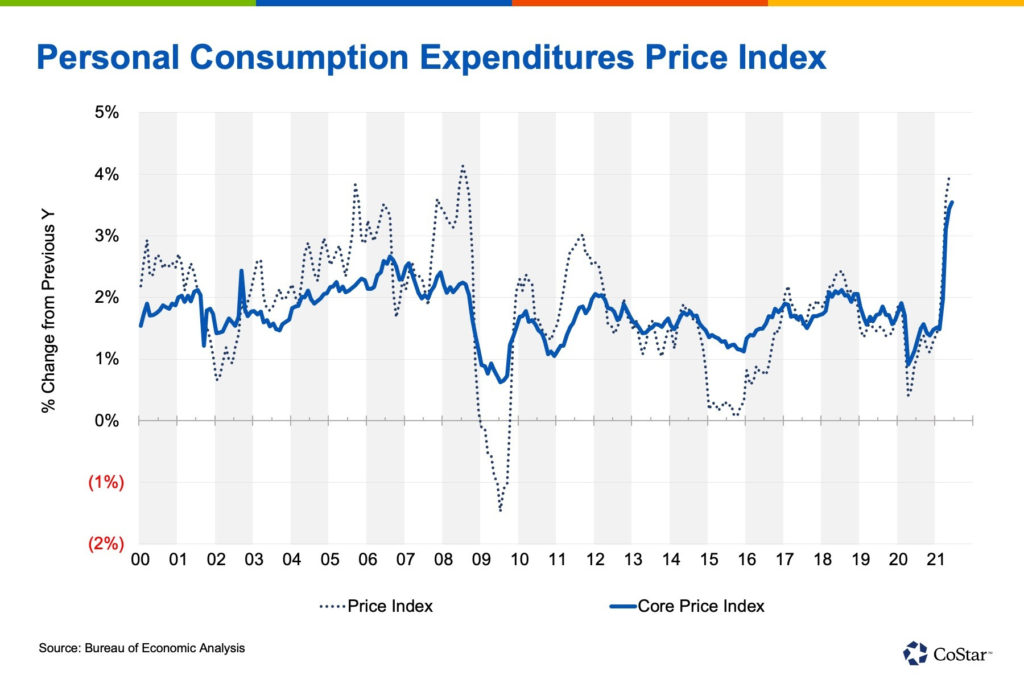

| Robust demand and consumer spending has caught many firms flat-footed as they face continued supply chain constraints and difficulties restocking their shelves. This has been pushing prices of some goods and services higher. The personal consumption expenditure price index for June, also released on Friday, showed an increase of 0.5% in June, with the year-over-year increase of 4% core personal consumption expenditure price index rose by 3.5% over the year, the highest since the early ’90s. |

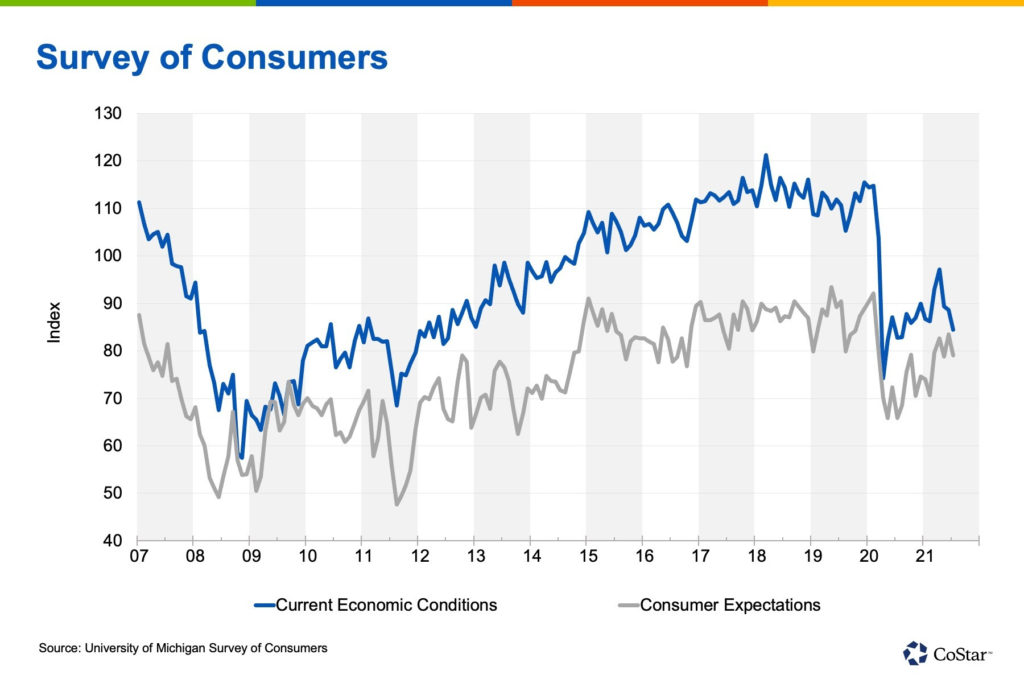

| Amid recent signs of inflationary pressures, it seems clear that the slow recovery in the labor market is what is holding the Federal Reserve back from taking its foot off the accelerator. At his press conference last week, Chairman Jerome Powell affirmed the Fed’s commitment to support the economy until inflation remains moderately above its 2% target “for some time,” which seems a long way off. For context, both headline and core inflation averaged 1.6% from 2010 to 2019, far below the Fed’s target. Evidently, the Fed’s apparent insouciance about price increases is not being entirely shared by consumers. The latest reading of the University of Michigan’s consumer sentiment survey showed the index falling by 4.3 points in July, its lowest reading since February. |

The Week Ahead …

Early July data for the production side of the economy arrive in the Institute for Supply Management surveys of purchasing managers in both manufacturing and services industries. Activity in both has been quite strong over the past few months, but supply chains have not cleared yet and inventory challenges persist. However, the economy continues to expand, and these reports should confirm healthy growth.

But the big news will likely come at the end of the week with the release of the July jobs report on Friday. The job market remains very strong, with job openings outnumbering unemployed workers. Expectations are that around 850,000 jobs were added in July, similar to the number added in May.

Still, the spread of the delta variant of the coronavirus could weigh on workers’ confidence about the return to work, as well as on the ability of firms to expand operations should restrictions be reimposed. Moreover, childcare challenges are likely to continue until schools reopen, keeping labor participation rates depressed.

CoStar Economy is produced weekly by Christine Cooper, managing director and chief U.S. economist, and Rafael De Anda, associate director of CoStar Market Analytics in Los Angeles.

Author Credit: CoStar Group Economy